What is the EDI 812 Credit/Debit Adjustment - Freight Accrual?

The EDI 812, also called the Credit/Debit Adjustment, is used to notify a trading partner of a monetary adjustment or to request that one be issued. It serves as the electronic version of a paper credit or debit memo. The EDI 812 communicates adjustments to costs for products or services and is often tied to prior purchase orders or invoices. It may also be used for adjustments not tied to a specific invoice, such as bill-back promotions or freight accruals.

The EDI 812 Credit/Debit Adjustment - Freight Accrual contains specific shipment reference information, including information including Shipment Identification, purchase order, and other tracking information the shipper determines to be pertinent/critical to the business process. The message also serves to track the value and dating of an accrual.

How does PartnerLinQ use the EDI 812?

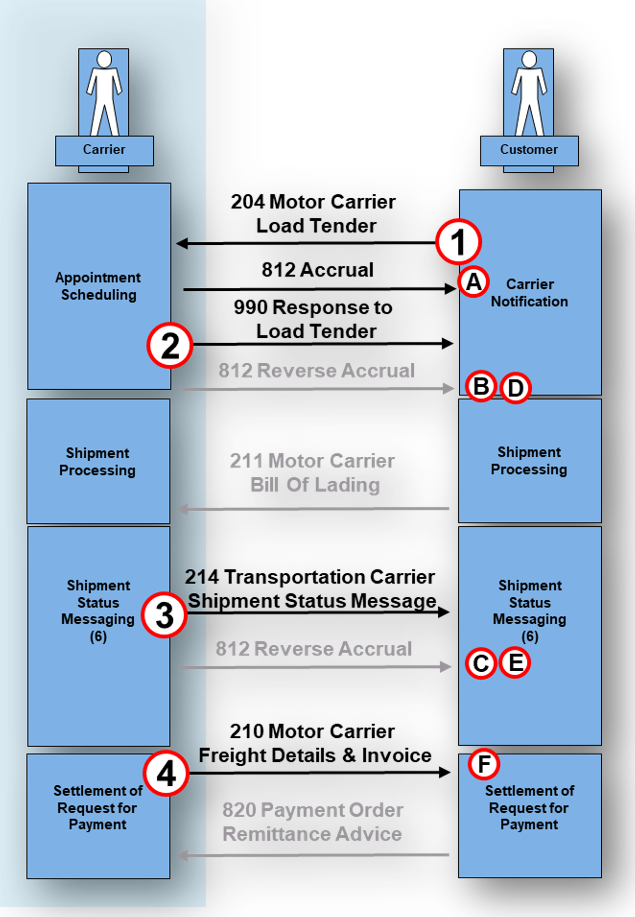

PartnerLinQ uses the EDI 812 Credit/Debit Adjustment - Freight Accrual to notify trading partners of a monetary adjustment that is being taken or to request that one be issued. These can include invoicing adjustment tied to an order to cash process (OTC) even freight charge adjustments. PartnerLinQ also uses the Credit/Debit Adjustment - Freight Accrual (812) to notify a party of an accrual related to the tendering of a shipment to a motor carrier. Freight Accrual typically takes place during the Load to Invoice (L2i) process, a process initiated by the Motor Carrier Load Tender (204) business, confirmed by the Response to a Load Tender (990) and executed by the Transportation Carrier Shipment Status Message (214), and ends with the the Motor Carrier Freight Details and Invoice (210)

uses the EDI 812 Credit/Debit Adjustment - Freight Accrual to notify trading partners of a monetary adjustment that is being taken or to request that one be issued. These can include invoicing adjustment tied to an order to cash process (OTC) even freight charge adjustments. PartnerLinQ also uses the Credit/Debit Adjustment - Freight Accrual (812) to notify a party of an accrual related to the tendering of a shipment to a motor carrier. Freight Accrual typically takes place during the Load to Invoice (L2i) process, a process initiated by the Motor Carrier Load Tender (204) business, confirmed by the Response to a Load Tender (990) and executed by the Transportation Carrier Shipment Status Message (214), and ends with the the Motor Carrier Freight Details and Invoice (210)

The 812 when used the Load-to-Invoice (L2i) process assists in tracking shipment references, purchase orders, and accrual values, while also managing accrual reversal scenarios depending on shipment status and invoicing.

What responses to the EDI 812 Credit/Debit Adjustment are expected/sent?

The EDI 812 while not a response document itself may be reconciled with acknowledgments (997) or related to transactions such as the 210 (Invoice) and 820 (Remittance Advice). It also works with the 204/990/214 cycle for freight accruals where a reversal might occurs upon invoice receipt or rejection of a load, ensuring accurate accounting.

What does the EDI 812 Credit/Debit Adjustment - Freight Accrual support?

The EDI 812 Credit/Debit Adjustment - Freight Accrual supports financial reconciliation processes for product and freight adjustments. It also supports accruals, ensuring that accruals are properly recorded and reversed, aiding accounts payable, receivable, and overall audit readiness.

What are the Key Features of the EDI 812 Credit/Debit Adjustment - Freight Accrual?

- Provides credit/debit adjustments for product or freight charges

- Supports freight accrual tracking and reversal

- Contains shipment and PO references for audit clarity

- Works with Load-to-Invoice (L2i) process

- Reduces manual reconciliation efforts

What is the Purpose of the EDI 812 Credit/Debit Adjustment - Freight Accrual?

The purpose of the EDI 812 is to streamline credit/debit adjustments, including freight accruals, to improve data accuracy, accelerate reconciliation, and reduce manual intervention.

What Information is Included in the EDI 812 Credit/Debit Adjustment - Freight Accrual?

The 812 typically includes:

| Information Category | Description / What’s Included | Primary Segment(s) |

|---|---|---|

| Transaction Control Information | Identifies the transaction type, control number, and version. | ST, SE |

| Adjustment Type & Reason | Indicates whether the transaction is a credit, debit, or adjustment, along with reason codes (pricing discrepancy, overcharge, accessorial correction, overpayment, freight rate change, etc.). | BCA, ADJ (CS Loop) |

| Adjustment Reference Information | References the original invoice, load tender, BOL, PRO number, shipment reference, or charge transaction being adjusted. | N9, REF |

| Trading Partner Identification | Identifies the buyer, seller, bill-to, and remittance party. May include carrier SCAC for freight scenarios. | N1, N2, N3, N4, PER |

| Freight Claim or Accrual Context | May include claim numbers, freight settlement reference, cost center, GL code, or accrual usage markers. | REF, NTE |

| Date & Time References | Original invoice date, adjustment date, service period, accrual effective date(s). | DTM |

| Line Item Adjustment Details | Line-level adjustments tied to individual charges, commodity lines, or accessorial charges. Includes rate differences, surcharges, fuel adjustments, and accessorial corrections. | IT1, ADJ, SAC (if used) |

| Charge Classification & Reason Codes | Standardized adjustment type codes defining reason (e.g., billing error, mileage discrepancy, detention/layover adjustment, fuel rate variance). | CS Loop, ADJ |

| Shipment Metrics Supporting the Adjustment | Optional supporting values such as weight, cube, mileage, equipment type, or accessorial classifications used for recalculation. | MEA, PID, SLN (conditional) |

| Tax, Fuel, and Surcharge Elements | Optional tax classification or carrier-specific freight surcharge logic applied as part of the correction. | TXI, SAC (conditional) |

| Remittance and Accounting Notes | Comments supporting financial resolution, accounting periods, settlement details, and audit notes. | NTE, MSG |

What are the Essential Components of the EDI 812 Credit/Debit Adjustment - Freight Accrual?

| Component Category | Purpose / Information Included | Primary Segment(s) |

|---|---|---|

| Transaction Header & Control | Establishes the start of the document and identifies the transaction set, version, and control number. | ST |

| Adjustment Identification & Purpose | Defines whether the request represents a credit, debit, or adjustment and communicates reason for the correction (pricing discrepancy, accessorial change, overcharge, mileage dispute, etc.). | BCD |

| Reference to Original Document(s) | Ties the adjustment back to the original freight invoice, PRO number, bill of lading, load tender, shipment ID, contract, or rate quote that is being corrected. | N9 |

| Credit/Debit Adjustment Detail | Provides line item adjustment details, including exceptions, credits, or debits for goods or services, along with adjustment reason codes and credit/debit indicators. | CDD |

| Trading Partner Party Identification | Identifies involved entities including payer, payee, bill-to party, carrier, remittance location, and contact details. | N1 Loop (N1, N2, N3, N4, PER) |

| Dates & Effective Periods | Specifies key dates such as invoice date, adjustment date, service period, dispute date, or accrual effective period. | DTM |

| Transaction Closure | Ends the document and provides validation counts and control verification. | SE |

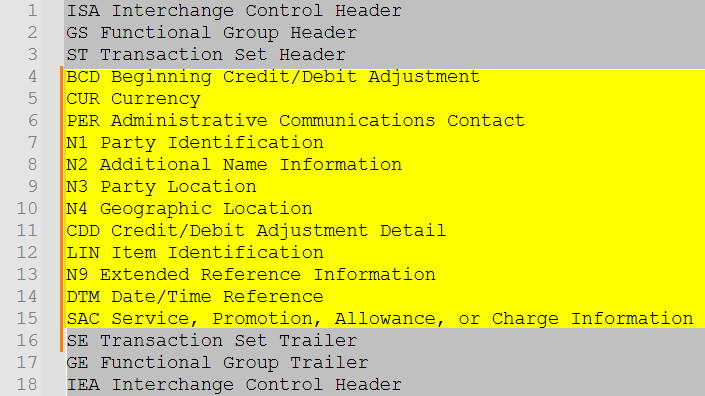

What are the Common Segments Included in the EDI 812 Credit/Debit Adjustment - Freight Accrual?

| Component Category | Purpose / Information Included | Primary Segment(s) |

|---|---|---|

| Transaction Header & Control | Establishes the start of the document and identifies the transaction set, version, and control number. | ST |

| Beginning Credit/Debit Adjustment | Used to transmit identifying dates and numbers for the transaction set and to indicate the monetary value to the receiver of the transaction. | BCD |

| Trading Partner Identification | Identifies the buyer, seller, bill-to, and remittance party. May include carrier SCAC for freight scenarios. | N1, N2, N3, N4, PER |

| Credit/Debit Adjustment Detail | Used to provide information relative to line item adjustment, detailing exceptions, credits, or debits for goods or services and includes elements such as an Adjustment Reason Code and a Credit/Debit Flag Code. | CDD |

| Dates & Effective Periods | Specifies key dates such as invoice date, adjustment date, service period, dispute date, or accrual effective period. | DTM |

| Transaction Closure | Ends the document and provides validation counts and control verification. | SE |

What Status Codes are used with the EDI 812 Credit/Debit Adjustment - Freight Accrual?

Accrual status is tracked with qualifiers:

- '92' Contract Effective Date (start of accrual)

- '93' Contract Expiration Date (respond-by deadline)

- '209' Contract Performance Start (carrier accepted)

- '276' Contract Start (picked up)

- '279' Contract Completion (delivered)

- '35' Delivered/Invoice Received

What Reason Codes are used with the EDI 812 Credit/Debit Adjustment - Freight Accrual?

The EDI 812 transaction set uses Adjustment Reason Codes (typically in the CAD02 or CDD01 data element) to specify the reason for a credit or debit adjustment.

- ‘71’ Advertising Allowance (Allowance for advertising funds)

- ‘77’ Competitive Allowance

- ‘82’ Defective Allowance:

- ‘GC’ Market Development Fund Deduction

- ‘GE’ Slotting Charge: Allowance for allocating shelf space to product.

What Use Cases does the EDI 812 Credit/Debit Adjustment - Freight Accrual support?

- Credit/debit adjustments for damaged or incorrect shipments

- Rebate and allowance adjustments

- Freight accrual creation and reversal in L2i cycle

- Audit trails for AP/AR teams

What are the Benefits of the EDI 812 Credit/Debit Adjustment - Freight Accrual?

- Improves financial accuracy

- Automates accrual and reversal processes

- Reduces manual entry errors

- Enhances auditability and compliance

How efficient is the EDI 812 Credit/Debit Adjustment - Freight Accrual?

The EDI 812 Credit/Debit Adjustment - Freight Accrual accelerates reconciliation in accounts payable and receivable. Speeds up tracking and decision-making for carriers and shippers.

How Compliant is the EDI 812 Credit/Debit Adjustment - Freight Accrual?

The EDI 812 Credit/Debit Adjustment - Freight Accrual Supports audit and accounting standards for adjustments.

What is the Format of the EDI 812 Credit/Debit Adjustment - Freight Accrual?

The EDI 812 Credit/Debit Adjustment - Freight Accrual follows ASC X12 v5010 EDI standard with PartnerLinQ delimiters.

How Accurate is the EDI 812 Credit/Debit Adjustment - Freight Accrual?

The EDI 812 Credit/Debit Adjustment - Freight Accrual improves consistency by linking shipment and PO references and standardizes data exchange for consistent reporting.

What are the Limitations of the EDI 812 Credit/Debit Adjustment - Freight Accrual?

Freight accrual practices vary by client and may require business process automation/configuration. Manual processes may still be undertaken or necessary in cases without business process automation.

Are Guidelines & Sample Files for the EDI 812 Credit/Debit Adjustment - Freight Accrual message available?

Yes. PartnerLinQ provides sample EDI 812 Credit/Debit Adjustment Transaction and implementation guides through its Support and Guideline Management Team. Sample EDI 812 implementation guides illustrate both inbound and outbound flows, segment layouts, and valid data examples and support testing and partner onboarding. Customized specification documents for use in on boarding and technical development are available upon request.

PartnerLinQ provides:

- EDI 812 Credit/Debit Adjustment transaction implementation guide

- Sample payloads

- Qualification and testing maps

- Error handling and best-practice notes

What are the Basic Questions for EDI Integration with the EDI 812 Credit/Debit Adjustment - Freight Accrual?

- Are there Samples and Specs available?

- What is the general direction of the transaction?

- Is the transaction meant to be treated as a Credit/Debit Adjustment or a Freight Accrual?

- When, in the view of the client, does the Credit/Debit Adjustment take place?

- When, in the view of the client does the freight accrual take place?

- When, in the view of the client does the reversal of freight accrual take place?

- If not an automated process, how does the client intend to reverse the freight accrual; is this an automated process triggered by an invoice?

- How will the detail be retrieved from or delivered to the ERP?

What Business Level Workflow does the EDI 812 Credit/Debit Adjustment - Freight Accrual support?

- A load is created and tendered with a 204.

- Carrier responds via 990.

- Shipment status is updated with 214.

- Freight accrual is recorded with 812.

- Final invoice (210) reverses accrual.

- Adjustments reconcile against AP/AR systems.

What are the Best Practices for using the EDI 812 Credit/Debit Adjustment - Freight Accrual?

- Validate shipment references (SID, PO) for accuracy

- Use consistent reason codes (CDD01) for audit clarity

- Align accrual timing with client expectations

- Automate reversal at invoice receipt

What Transactions are associated with the EDI 812 Credit/Debit Adjustment - Freight Accrual?

| Transaction | Role |

|---|---|

| 204 | Motor Carrier Load Tender |

| 990 | Response to Load Tender |

| 214 | Shipment Status |

| 210 | Freight Invoice |

| 810 | Electronic Invoice |

| 820 | Payment Order / Remittance Advice |

| 850 | Purchase Order |

| 997 | Functional Acknowledgment |